Achieve MoreTM

Through Every Step of the Insurance Lifecycle

Transform Each Department and Increase Performance

Lets Talk

How Insurance Companies

Get Results with ISI

Better Manage Risk

Enhance underwriting precision and exposure control.

Unlock Real-Time Insights

Unify policy, billing, claims, accounting and reinsurance data to drive better decisions.

Enhance Operational Efficiency

Streamline customer, team and distribution channel experience.

Drive Sustainable Growth

Accelerate product rollouts and policy changes while lowering total cost of ownership.

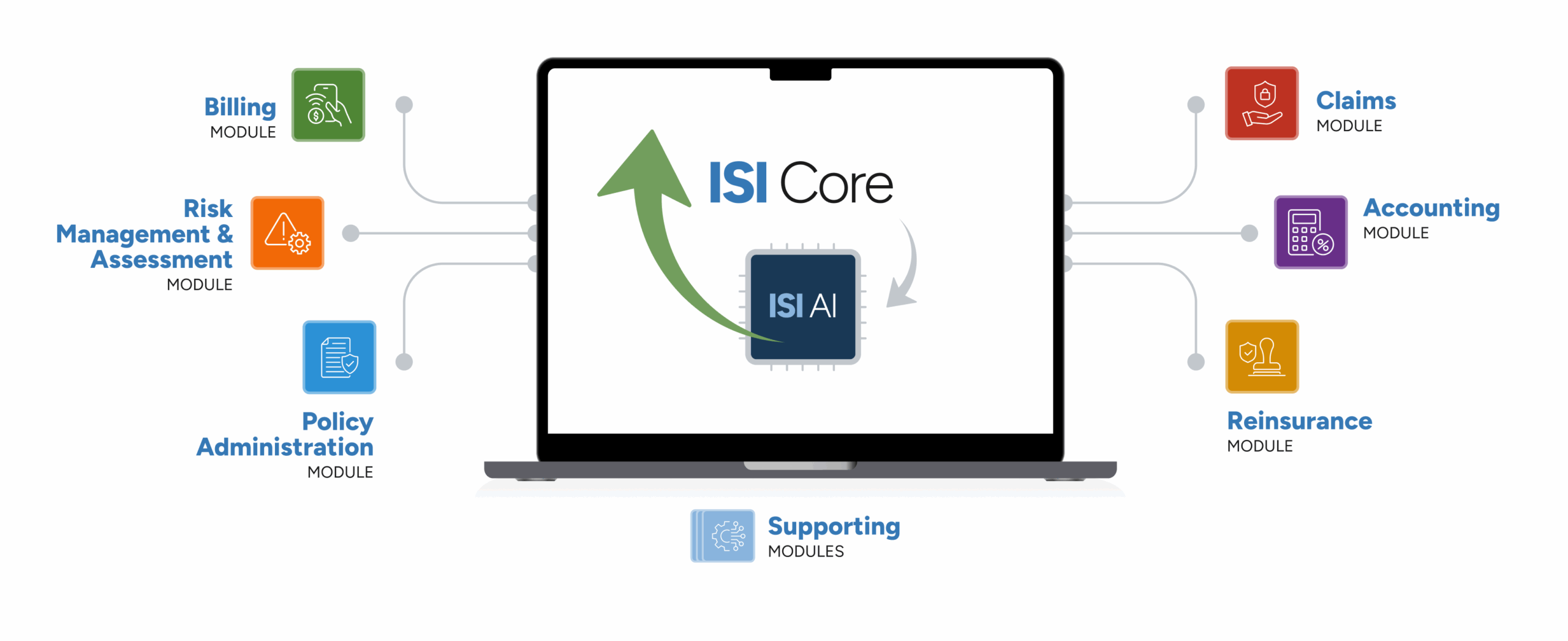

ISI CoreTM

Grow profitably with the automation, insight, and control needed to manage the full insurance lifecycle

ISI AITM

Enhance underwriting responsiveness and accelerate time to quote by eliminating repetitive manual tasks.

ISI PortalTM

Deliver secure digital services that improves efficiency for policyholders, brokers, and internal teams

Flexible Solutions for Every Line of Business

Personal Lines

Solutions that solve for high transaction volume with low touch while still creating loyal customers

Commercial Lines

Solutions that solve for multi-line programs, large accounts and sophisticated exposures

Professional Liability

Solutions that solve the complexity of claims-made coverage, retroactive dates, and evolving defense costs

Specialty Lines

Solutions that thrive unique and innovative products and risks

The successful launch supported our entry into the Canadian insurance market. Having our department leads work closely with our technology solutions team and ISI’s team resulted in hitting our target delivery on time and under budget. ISI has been incredibly responsive and great to work with.

Achieve Business Outcomes Faster

Customers experience a proven path from implementation to impact

Partnering with a technology provider that understands our business and has a flexible solution to meet our business goals was of utmost importance to us. ISI has consistently demonstrated that they are an effective partner for our long-term business strategy.

FAQs

Who uses ISI and is it right for our size or type of insurance operation?

ISI is trusted by insurers, mutuals, MGAs, and specialty carriers across Canada and the U.S. Its modular architecture and configurable product framework make it well-suited for mid-market insurers seeking modern capabilities without the complexity or overhead of large legacy systems.

↓

What differentiates ISI from other core insurance platforms?

ISI offers one unified platform with insurance-specific accounting, advanced reinsurance capabilities, real-time financial posting, and a single data model across all modules. Combined with no-code configuration tools, ISI helps insurers reduce system complexity, accelerate product changes, and lower total cost of ownership.

↓

How does ISI help customers “Achieve More”?

ISI enables insurers and MGAs to enhance underwriting precision, improve operational efficiency across teams and channels, strengthen risk management and accounting accuracy, and unlock real-time insights from policy, billing, claims and reinsurance data. It also supports sustainable growth by reducing manual work and system fragmentation. From lifecycle automation in ISI CoreTM to AI-driven submission intake and risk evaluation in ISI AITM to modern digital self-service through ISI PortalTM, ISI equips carriers and MGAs to adapt quickly and operate with agility.

↓